In 2025, a FinTech CISO is responsible for more than just server security; they are also tasked with preserving board confidence, compliance, and trust. Cloud has allowed FinTech to innovate quickly, but it has also increased the attack surface. Attackers are more swift, regulators are more stringent, and boards are calling for quantifiable risk reduction.

Here are the Top 5 cloud threats every FinTech CISO must address in 2025 — with real-world attack paths and practical board-ready takeaways.

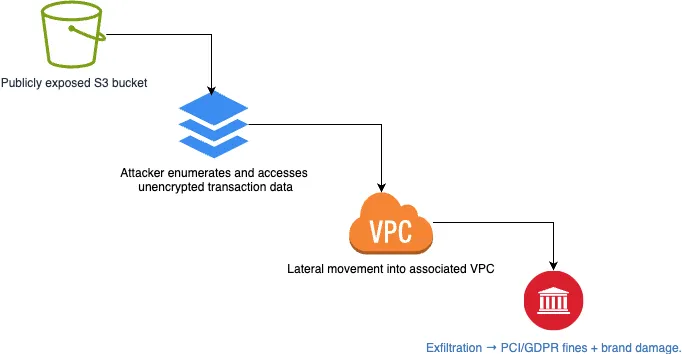

1. Misconfigured Cloud Storage = Breach Goldmine

Misconfigured cloud storage continues to be the leading cause of FinTech security breaches. In fact, insufficiently secured buckets or blobs were the initial cause of more than 60% of financial data breaches during the previous two years.

Why it matters for FinTech:

- PII, transaction logs, or KYC documentation are frequently exposed by improperly configured S3, GCS, or Azure Blob storage.

- Attackers search the internet for these configuration errors using automated tools.

Attack Path Example:

Business Impact:

- Regulatory fines (PCI DSS non-compliance: up to $100,000/month).

- Loss of consumer trust in financial data handling.

- Incident response costs that can exceed millions.

CISO Playbook Action:

- Enforce default deny-all configurations.

- Run continuous CSPM (Cloud Security Posture Management) scans.

- Deploy “guardrails” IaC templates for dev teams.

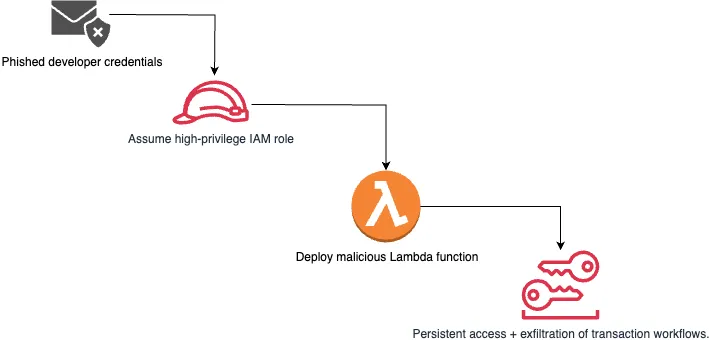

2. Over-Permissive IAM Roles = One Key to Rule Them All

FinTechs are quick. They frequently grant developers administrator-level access to the entire environment in the process.

Why it matters for FinTech:

- Complete environment takeover may be possible with stolen developer credentials that have too many IAM permissions.

- Insider fraud risk grows if IAM isn’t tightly segmented.

Attack Path Example:

Business Impact:

- Complete service downtime (fraudulent code execution in production).

- Regulatory breach (insufficient access control violates PCI DSS Req. 7).

- Board-level accountability (insider + external compromise risk).

CISO Playbook Action:

- Audit cross-account access policies.

- Enforce least privilege by default.

- Deploy just-in-time access workflows.

- Rotate IAM keys every 90 days.

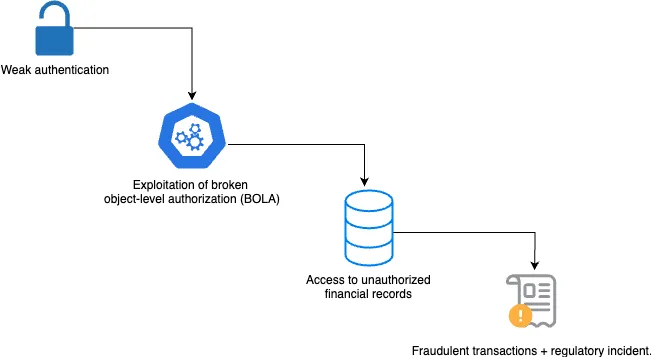

3. Unsecured APIs in the Cloud = The New Bank Vault Door

FinTech relies heavily on APIs to power identity verification, banking integrations, and payments. However, they are also among the cloud components that are most frequently exploited.

Why it matters for FinTech:

- APIs often handle sensitive transaction data.

- Misconfigurations (lack of auth, poor rate limiting) expose millions of records.

Attack Path Example:

Business Impact:

- Fraud exposure (stolen customer data → account takeover).

- Audit findings (failure to secure APIs violates SOC 2 + ISO 27001).

- Board-level risk metrics spike (unexplained fraud losses).

CISO Playbook Action:

- Integrate API scanning into CI/CD pipelines.

- Enforce TLS 1.3 on all APIs.

- Adopt continuous DAST/API security testing.

- Implement API gateways with rate limiting.

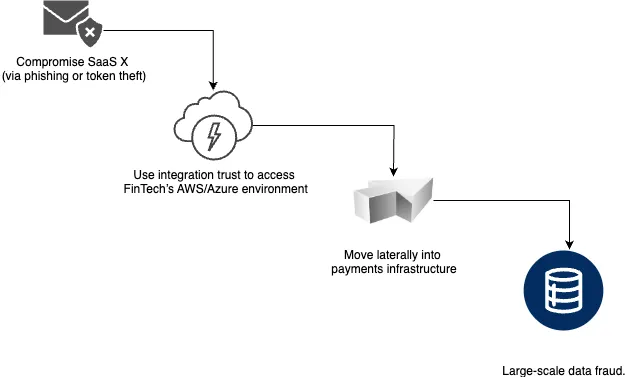

4. Weak Cloud-to-Cloud Integrations = Hidden Trust Chains

FinTech businesses depend on dozens of SaaS and PaaS integrations, including CRM, analytics platforms, fraud detection tools, and compliance solutions. However, each integration creates a new avenue for attack.

Why it matters for FinTech:

- API keys and OAuth tokens are frequently long-lived and not adequately monitored.

- A compromise in one SaaS app can cascade into core financial systems.

Attack Path Example:

Business Impact:

- Third-party breach liability.

- Compliance violations (failure to manage vendors under ISO 27001 A.15).

- Reputational collapse if fraud originates from a trusted vendor link.

CISO Playbook Action:

- Run periodic third-party security reviews.

- Maintain a full SaaS app inventory.

- Monitor OAuth tokens + third-party API calls.

- Enforce MFA + conditional access for integrations.

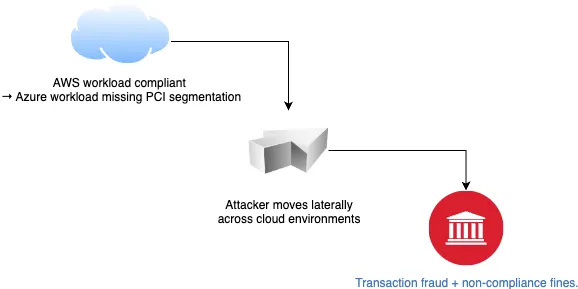

5. Compliance Blind Spots in Multi-Cloud = Audit Chaos

“Checkbox security” is no longer enough for regulators. By 2025, living, continuously validated controls will be required by PCI DSS 4.0, SOC 2, and ISO 27001.

Why it matters for FinTech:

- Multi-cloud setups (AWS + Azure + GCP) create fragmented controls.

- CISOs struggle to show holistic audit readiness.

Attack Path Example:

Business Impact:

- PCI fines up to $500K+ per incident.

- Lost banking partnerships (non-compliance = vendor risk).

- Audit fatigue for CISO teams.

CISO Playbook Action:

- Align controls to PCI DSS Req. 12 (continuous risk assessments).

- Centralize GRC dashboards across clouds.

- Run quarterly Red Team exercises with compliance-focused objectives.

Executive Takeaway: What to Tell Your Board

Cloud threats in FinTech are no longer just IT issues. They directly impact:

- Revenue: through fraud and downtime.

- Compliance: through PCI/ISO/SOC 2 penalties.

- Reputation: through customer trust erosion.

As a FinTech CISO in 2025, your board needs to hear that you are:

- Eliminating misconfigurations & IAM excess.

- Continuously securing APIs and SaaS integrations.

- Treating compliance as a living control system.