Mergers and acquisitions fail for many reasons — but in 2026, undiscovered cyber risk has become one of the most expensive and least visible deal killers.

Traditional cyber due diligence still relies heavily on:

- Questionnaires

- Compliance attestations

- Vulnerability scans

- Limited penetration testing

These approaches answer one question:

“Do controls exist?”

They do not answer the question that matters in an acquisition:

“If this company were attacked tomorrow, how bad would it actually be?”

That gap is exactly where red teaming for M&A cyber risk assessments fits.

This guide explains:

- Why traditional M&A cyber due diligence fails

- What red teaming reveals that other methods miss

- How red teams are used pre- and post-close

- What buyers, boards, and insurers actually care about

- When red teaming is (and is not) appropriate in a deal

This is written for deal environments where time, accuracy, and business impact matter.

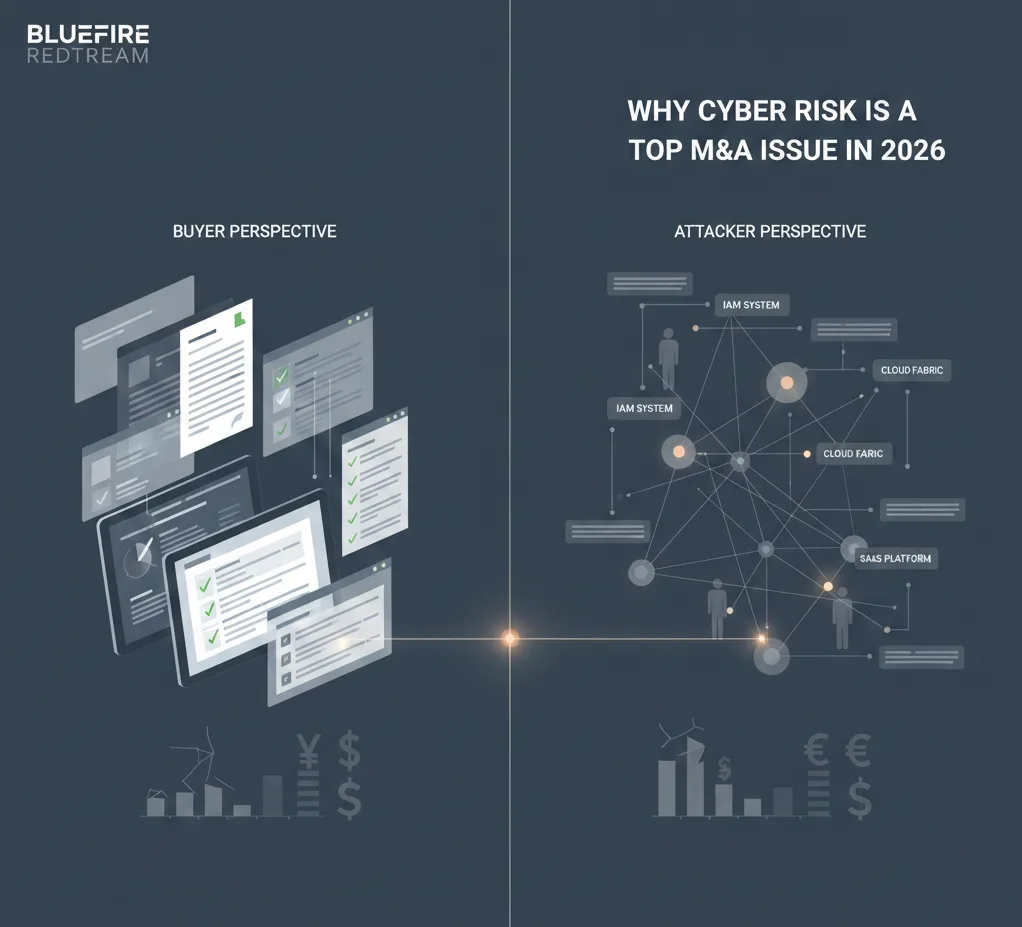

Why Cyber Risk Is a Top M&A Issue in 2026

In 2026, most material cyber risk is:

- Identity-based (not perimeter-based)

- Cloud and SaaS–centric

- Human-enabled

- Chained across systems

- Poorly documented

This creates a dangerous mismatch during M&A:

| What Buyers See | What Attackers See |

|---|---|

| Policies | Privileges |

| Diagrams | Attack paths |

| Questionnaires | Exploitable trust |

| Compliance | Opportunity |

As a result:

- Breaches occur during integration

- Incidents surface post-close

- Deal value erodes after valuation

- Buyers inherit unknown liability

Red teaming exists to close that visibility gap.

What Is Red Teaming in an M&A Context?

Red teaming for M&A is not a standard red team engagement and not a compliance exercise.

It is a time-boxed, objective-driven adversary simulation designed to answer one core question:

What is the realistic cyber downside of acquiring this organization?

In an M&A context, red teaming focuses on:

- Likely attacker entry points

- Lateral movement paths

- Privilege escalation

- Access to sensitive data

- Ability to disrupt operations

- Detection and response maturity

- Business impact, not just technical findings

The output is decision intelligence, not a vulnerability list.

Red Teaming vs Traditional M&A Cyber Due Diligence

Traditional Due Diligence Answers:

- Are controls documented?

- Are audits passed?

- Are tools deployed?

Red Teaming Answers:

- Can an attacker get in?

- How far can they go?

- What assets are truly at risk?

- Would this be detected?

- How would leadership respond?

In 2026, buyers increasingly use red teaming as a reality check against paper-based diligence.

When Red Teaming Is Used in the M&A Lifecycle

1. Pre-LOI / Early Diligence (Selective)

Used when:

- The target handles sensitive data

- The deal involves regulated industries

- There is limited internal security visibility

Goal:

Identify deal-breaking cyber risk early

2. Pre-Close (Most Common)

Used when:

- Valuation is being finalized

- Cyber risk may affect price, escrow, or representations

- Integration plans depend on security maturity

Goal:

Quantify cyber downside before ownership transfers

3. Post-Close / Pre-Integration

Used when:

- Networks are about to be connected

- Identity systems will be merged

- Access boundaries are changing

Goal:

Prevent integration-triggered breaches

What Red Teaming Reveals That Others Miss

In M&A assessments, red teams commonly uncover:

- Excessive identity privileges

- Dormant but exploitable accounts

- Weak SaaS access controls

- Poor segmentation between environments

- Blind spots in detection and logging

- Overconfidence in compliance posture

Most importantly, red teaming reveals how multiple small issues chain together into material business risk.

What Buyers, Boards, and Insurers Care About

Red teaming results are valuable when they are framed correctly.

Effective M&A red team reporting focuses on:

- Attack narrative, not tool output

- Business impact, not CVEs

- Likelihood, not theoretical risk

- Time-to-detection

- Blast radius

- Cost of remediation vs cost of breach

This is the level of clarity required for:

- Board discussions

- Deal negotiations

- Cyber insurance decisions

- Integration planning

How Red Teaming Influences Deal Decisions

Red teaming is increasingly used to:

- Adjust purchase price

- Negotiate escrow or holdbacks

- Require remediation pre-close

- Restructure integration timelines

- Prioritize post-close investment

- Inform representations and warranties

In some cases, it has prevented buyers from inheriting unknown, material cyber liabilities.

Common Mistakes in M&A Red Teaming

❌ Treating It Like a Normal Red Team

M&A red teaming must be:

- Faster

- More focused

- Less disruptive

- Explicitly scoped to deal risk

❌ Over-Scoping

You do not need a 90-day engagement.

You need targeted adversary simulation aligned to:

- The target’s threat profile

- The buyer’s risk tolerance

- The integration plan

❌ Ignoring Human & Identity Risk

Most M&A cyber failures stem from:

- Identity misalignment

- Trust relationships

- Privileged access sprawl

If these are not tested, the assessment is incomplete.

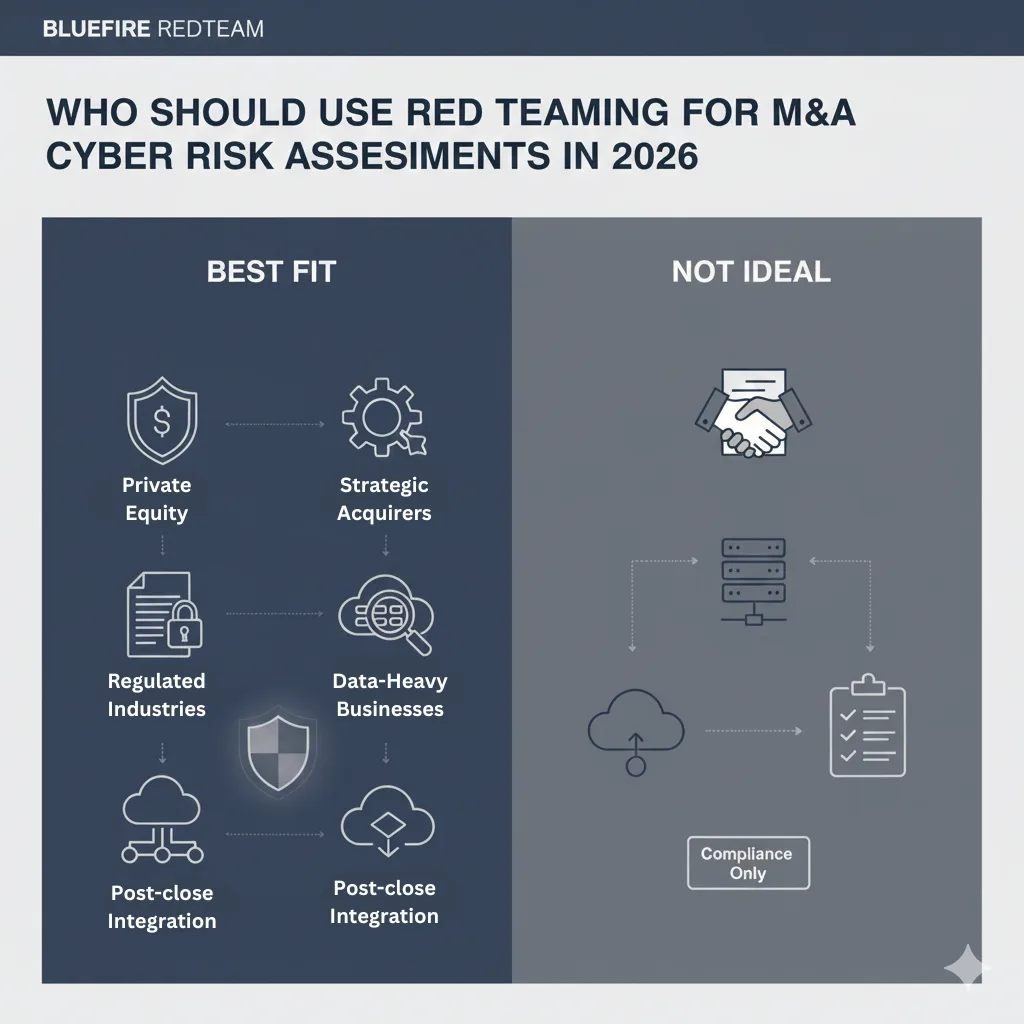

Who Should Use Red Teaming for M&A Cyber Risk

Best fit:

- Private equity firms

- Strategic acquirers

- Regulated industries

- Data-heavy businesses

- Companies integrating environments post-close

Not ideal for:

- Very small asset acquisitions

- Deals with no system integration

- Checkbox-only compliance diligence

Final Thoughts: Red Teaming as Deal Protection

In 2026, cyber risk is no longer a technical concern — it is a deal risk.

Red teaming for M&A cyber risk assessments provides:

- Reality over assumptions

- Visibility over paperwork

- Decision intelligence over noise

For buyers, it answers the question that matters most:

“What are we actually buying from a cyber risk perspective?”

Next Steps

If you’re evaluating an acquisition and need clarity on cyber downside:

👉 Talk to a Red Team Operator

(No sales pitch. Confidential. Deal-aware.